The performance of emerging-markets stocks has been very disappointing in 2013, due, in part, to taper talk in the United States and slowing growth among many of the high flyers of the last decade, including China and Brazil. Frontier markets, on the other hand, have had a standout year, with the MSCI Frontier Markets Index returning 21.1% in the first 10 months of the year, trouncing the MSCI Emerging Markets Index's return of 0.3%.

Aren't frontier markets just less developed emerging markets? Why has there been such a discrepancy in performance?

Getting in Early

The investment case for frontier markets sounds enticing. These countries, such as Vietnam, Nigeria, and Pakistan, are at an earlier stage of development relative to emerging-markets countries, and some are entering a period of mid- to high-single-digit growth, thanks to favourable demographics, infrastructure spending, and an improving business environment. Innovations in financial services in Africa, through mobile and agency banking, will allow for rapid expansion of low-cost banking services and credit, which will likely support more broad-based and inclusive growth.

Another positive trend is that a number of resource-rich countries have been able to channel some revenues from the export of raw materials into infrastructure and social spending.

Source: Morningstar Direct

Source: Morningstar Direct

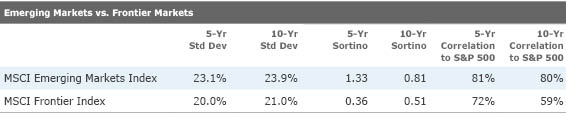

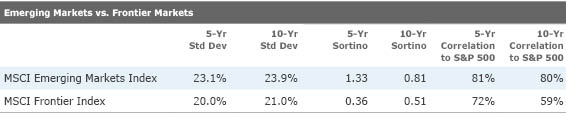

Although frontier economies are less developed than emerging economies, the MSCI Frontier Index has been less volatile than the MSCI Emerging Markets Index over the past 15 years. Part of this is attributable to the fact that individual frontier countries have low correlations with each other. Another reason is the relatively low level of foreign ownership of frontier-markets stocks.

One of the main drivers of volatility in emerging-markets equities during the past few years has been the fact that emerging-markets equities have been considered a "risk on” asset class in the recent "risk-on, risk-off" trading environment. Given the relatively low foreign investor penetration in frontier-markets stocks and bonds, this asset class has not been as susceptible to this hot money-driven volatility.

Source: MSCI

(The table above under-represents global assets in emerging and frontier markets, as it includes only those assets that are benchmarked to MSCI indexes. However, the data is illustrative of the relative penetration of global assets in emerging markets versus frontier markets.)

Strong frontier-markets performance has not gone unnoticed by investors. While there are only a handful of diversified frontier-markets funds, some have seen organic growth rates in the eye-popping 200% to 300% range, versus the category average of 9% over the first 10 months of this year.

What are the Risks?

The MSCI Frontier Market Index covers about 85% of the free-float-adjusted market capitalization of 25 frontier stock markets. The index has a total of 142 constituents, whose combined free-float-adjusted market capitalization is around US$130 billion, equivalent in size to the market capitalization of individual companies such as PepsiCo (PEP). By way of comparison, the free-float-adjusted market capitalization of the MSCI Emerging Markets Index is US$3.9 trillion. With such limited capacity, strong inflows into frontier-markets stocks will likely drive markets higher. However, any sudden pull-back by foreign investors could result in brutal declines. Emerging Southeast Asian markets, which boast far more liquidity than frontier markets, were recently victims of this phenomenon. For example, iShares MSCI Philippines (EPHE, listed in the U.S.) and iShares MSCI Thailand (THD, listed in the U.S.) enjoyed an 80% and 60% climb, respectively, from January 2012 through mid-May this year, due in part to surging inflows into both local equities and bonds, which drove up both equity prices and currencies. The rally hit a wall when the Federal Reserve Chairman Ben Bernanke first hinted at an eventual tapering of the Fed’s asset purchases, and in the following three months, these funds each fell 30%. If investors continue to pile into frontier markets, they too will become part of the risk-on, risk-off trade, and will likely grow more correlated with U.S. markets.

Most investors are familiar with the main risks associated with frontier markets, which include political instability, social unrest, widespread corruption, and a fickle regulatory environment. For example, during the Egyptian Revolution of 2011, the local stock market shut down for 40 consecutive days.

How Can I Invest?

After acknowledging the many risks to frontier markets, investors should also carefully weigh the pro and cons of the different funds offering exposure to this very niche asset class.

Passively managed iShares MSCI Frontier (FM, listed in the U.S.) is by far the cheapest option for geographically diversified frontier-markets exposure available in the U.S. This ETF has an annual expense ratio of 0.79%. Since inception in September 2012, this fund has trailed its index by 40 basis points, which is less than its annual expense ratio, indicating the fund is doing a good job tracking its index. However, a bigger challenge looms for the managers of this fund, in the form of a large index change, which was announced by MSCI last June. In November this year, Morocco was downgraded from the MSCI Emerging Markets Index (where it currently accounts for 0.01% of the index) to the Frontier Markets Index (where it will account for about 4%), and in May 2014, Qatar and UAE will be upgraded from the Frontier Market Index (where together they account for 30%) to the Emerging Markets Index (where together they will account for around 1%).

Index-tracking funds that invest in relatively illiquid securities face two key challenges--front running and market impact costs. These issues affect both the fund and the index, making it difficult to measure their effect. Morocco’s Casablanca Stock Exchange expects the market downgrade will result in additional fund flows--Morocco currently accounts for 0.01% in the MSCI Emerging Markets Index but will account for about 4% of the MSCI Frontier Index after the November change. So while emerging-markets fund managers may have ignored Morocco because it represented a small sliver of their benchmark, frontier-markets fund managers will likely consider Moroccan stocks given their more significant weighting in the frontier benchmark. Moroccan stocks have enjoyed somewhat of a rally during the past few months, which the iShares MSCI Frontier fund will have missed when it adds Moroccan securities on Nov. 27. The fund may also further fuel the rally on and around the index change date, given the size of the fund and the relatively low liquidity of Moroccan stocks. Following this and the May index changes, FM’s portfolio will be more concentrated, as Kuwaiti stocks (which will account for about 30% of the fund’s portfolio) and Nigerian stocks (20%) will account for roughly half of its assets.

As Morocco may benefit from a downgrade to frontier status, Qatar and UAE may benefit from an upgrade to emerging-markets status. Often, a country is upgraded in recognition of significant economic reforms, which are often a precursor to an improved growth outlook. Reclassification also raises the profile of a country’s stock market within the foreign investment community and could drive significant capital inflows. Egypt was a glowing success story for a few years after it was added to the MSCI Emerging Markets Index in June 2001. Thanks to tariff cuts, economic liberalization, and privatization, Egypt enjoyed strong increases in foreign direct investment and portfolio inflows, and from 2003 to 2007, the MSCI Egypt Index returned an average of 84% a year. A strict, frontier-markets index fund such as FM would have missed out on this type of market performance.

That said, the Egypt story has definitely taken a more negative turn in more recent years, and MSCI is currently looking to remove Egypt from the Emerging Markets Index as it has become more difficult for foreign investors to repatriate their capital. This is yet another example of the many risks of this asset class.

In Asia, choices are limited to ETFs tracking individual frontier markets, i.e. they are not tracking the broad frontier markets. In Hong Kong and Singapore, the db-X trackers ETFs offer country exposure in Bangladesh, Pakistan and Vietnam (HK stock codes: 03105, 03106, 03087; Singapore stock codes: O9C, O9D, HD9).

.png)