All market indices, category averages and fund performance are quoted in HKD for comparison purposes.

Market Overview

The market continued to watch the U.S. Federal Reserve closely for signs on when it will raise interest rates. On one hand, the Fed dropped the word “patient” from its March statement, which may be interpreted as paving the way for a rate hike earlier than expected. On the other hand, the statement also lowered its projections for economic growth, inflation and interest rates. Combined with cautious comments from the Fed, some believe the increase may be put off until later in the year. All-in-all, the S&P 500 index posted a meagre gain of 0.41% in the first quarter.

After the eurozone officially slid into deflation in December 2014, the European Central Bank (ECB) announced a quantitative easing program on 22 January 2015 that entailed the bond purchase of EUR60 billion each month. The program commenced on 9 March and will last until at least September 2016, with the aim of raising eurozone inflation to its target of just under 2%. Following the implementation of such expansionary monetary policy and factoring in the expected tailwinds associated with lower oil prices and euro depreciation, the ECB has raised its growth forecast for the eurozone to 1.5% from the 1% predicted in December 2014. The European stock market responded well to the policy and the MSCI Europe index clocked a robust quarterly gain of 16.56% when quoted in euros. However, the euro’s 11.24% depreciation against the US dollar in the first quarter (to which the Hong Kong dollar is pegged) led to a diminished reading of 3.43% when measured in Hong Kong dollars.

As widely expected, the Bank of Japan (BoJ) maintained its monetary stimulus plan of purchasing JPY80 trillion worth of Japanese government bonds each year. Given the sharp fall in oil prices, the BoJ has lowered its inflation forecast to about zero “for the time being”. This compares with the BoJ’s inflation target of 2%. Nonetheless, the Nikkei surged to 15-year highs in March and was up 10.01% for the quarter. The yen stabilised against the US dollar over the first quarter and therefore currency had a neutral impact on Hong Kong dollar returns, though the yen remained weak overall and depreciated by 22.07% against the US dollar year-on-year.

The Fed’s dovish stance has led some to believe it will not raise interest rates in the near future and 10-year Treasury yield fell to 1.94% from 2.12% in the quarter. The large-scale purchase of government bonds by the ECB and BoJ has also put downward pressure on bond yields, with 10-year German bunds and 10-year Japanese government bond yields finishing the quarter at 0.22% and 0.40% respectively. Given the strength of the US dollar against the major currencies, the Barclays Global Aggregate index was down by 1.94% for the quarter despite the low yields.

China narrowly missed its 2014 growth target of 7.5% as official GDP registered at 7.4% for the year. Amid a slowing economy, the country faced rising deflationary pressure and CPI hit a five-year low of 0.8% in January 2015. In response, the People’s Bank of China (PBOC) lowered the reserve requirement ratio (RRR) in February by 50 basis points to 19.5% to inject liquidity into the market. This was the first broad-based cut since May 2012. Later that month, the PBOC cut the benchmark interest rate for the second time since November 2014. Effective 1 March 2015, one-year deposit and lending rates were reduced by 25 basis points each to 2.5% and 5.35% respectively. In late March, new stimulating measures were put in place to reinvigorate the sluggish property market. Premier Li Keqiang announced at the National People’s Congress a lowered GDP target of “around 7%” for 2015, signalling a “new normal” of slower growth for China. Regardless, China A-shares continued to rocket and the CSI 300 index ended the first quarter with a 14.70% gain. The Hang Seng index was up 5.49% for the quarter.

MPF Performance

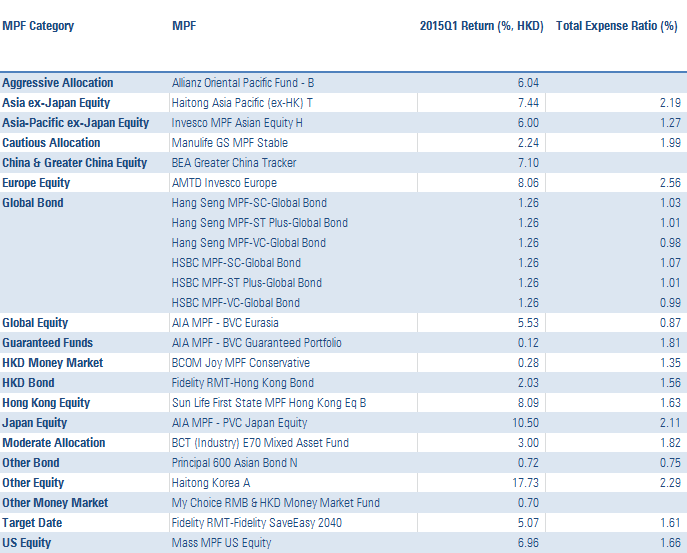

Most of our MPF categories posted positive returns in the first quarter of 2015, save for a couple of bond categories. On the back of a soaring Japanese stock market and a stable yen, Japan Equity MPFs reversed their downward trend in 2014 and posted the strongest returns among all MPF categories this quarter, gaining 9.96% on average. Within the category, AIA MPF – PVC Japan Equity led the pack with an impressive quarterly gain of 10.50%.

Aided by the ECB’s monetary stimulus, European stocks also rallied and our Europe Equity category was up by a solid 6.20% on average. AMTD Invesco Europe beat its peers by returning 8.06% for the quarter.

Hong Kong Equity MPFs were among the front runners this quarter, posting an average gain of 5.39%. The best performer in the category was Sun Life First State MPF Hong Kong Eq B, which returned an attractive 8.09% for investors. China and Greater China Equity MPFs, Hong Kong investors’ favourite category, also delivered a respectable average quarterly gain of 4.99%. BEA Greater China Tracker topped the category with a 7.10% gain. This fund aims to match the performance of the FTSE Greater China HKD index, which was up by 5.92% in the first quarter.

Despite low bond yields, the strong US dollar has eroded the price performance of non-USD denominated bonds. As a result, the worst-performing MPF category of the quarter was Global Bond, which made an average loss of 0.97%. That said, category winners Hang Seng Global Bond and HSBC Global Bond (available on their respective SimpleChoice, SuperTrust and Value Choice schemes) managed to stay afloat by returning 1.26% for the quarter.

As always, we believe investors are best served by adhering to their long-term investment plans with a well-diversified portfolio and avoid being swayed by short-term changes in the macroeconomic environment. Furthermore, investors should not rely on simple performance data when making investment decisions. A key factor to consider is fees, as high fees erode an MPF’s future returns potential. Different MPFs bear varying degrees of risk; for example, equity funds are generally riskier than bond funds and investors should select their MPFs according to their own risk appetite and tolerance.

Q1 2015 Best Performing MPFs by Category

.png)