For economic and market news relating to Asian ETFs, please refer to our “Asia ETF Roundup (Market) – September 2016“.

ETF Industry News

China Relaxes RQFII Quota System

On 5 September 2016, the People’s Bank of China (PBoC) and the China State Administration of Foreign Exchange (SAFE) jointly announced, with immediate effect, the relaxation of the RQFII Quota System. Followed by the relaxation of the QFII system in February 2016, the relaxation of the RQFII system represents another step in internationalisation of the Chinese capital market. Major modifications of the RQFII scheme are listed as follows:

(1) The RQFII licensees will be awarded base quota not exceeding a proportion of the firm’s assets under management (AUM). Sovereign wealth funds, central banks and monetary authorities are not subject to this rule.

(2) If the majority of the AUM is offshore, the RQFII licensee could obtain a base quota of USD 100 million plus 0.2% of 3-year average AUM, minus quota obtained under the QFII scheme.

(3) If the majority of the AUM is onshore, the RQFII licensee could obtain a base quota of RMB 5 billion plus 80% of the AUM of the previous year, minus quota obtained under the QFII scheme.

(4) If the desired investment quota exceeds the base quota, RQFII licensee will need to seek approval from the SAFE.

(5) Apart from open-end funds, the AUM of the RQFII licensees would lock up for 3 months (compared to 1-year lock up previously), beginning from the day the onshore AUM reaches RMB 100 million.

Bank of Japan Launches “QQE with Yield Curve Control”; Changes ETFs Purchase Composition

On 21 September 2016, the Bank of Japan (BoJ) announced the introduction of “Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control” to achieve inflation of 2% at the earliest possible time. By way of “yield curve control”, the BoJ will control short-term and long-term interest rates and have an “inflation-overshooting commitment” in which the BoJ will expand the monetary base until the year-on-year rate of increase in the observed CPI exceeds the target of 2%.

While maintaining the total purchase size for its JPY 6 trillion annual ETF purchase programme, the BOJ changed the composition of its ETF purchase plan as follows:

From- The maximum amount of each ETF to be purchased, for ETFs that track any of the three indices (the Tokyo Stock Price Index [TOPIX], the Nikkei 225 Stock Average, or the JPX-Nikkei Index 400 [JPX-Nikkei 400]), shall be set so that the Bank's purchase would roughly be proportionate to the total market value of that ETF issued.

To- (1) Of the annual purchase amount of JPY 5.7 trillion, JPY 3 trillion will be used for ETFs that track any of the three indices (the Tokyo Stock Price Index [TOPIX], the Nikkei 225 Stock Average, or the JPX-Nikkei Index 400 [JPX-Nikkei 400]). The maximum amount of each ETF to be purchased shall be set so that the Bank's purchase would roughly be proportionate to the total market value of that ETF issued; and (2) The remaining JPY 2.7 trillion will be used for ETFs that track the TOPIX. The maximum amount of each ETF to be purchased shall be set so that the BoJ's purchase would roughly be proportionate to the total market value of that ETF issued.

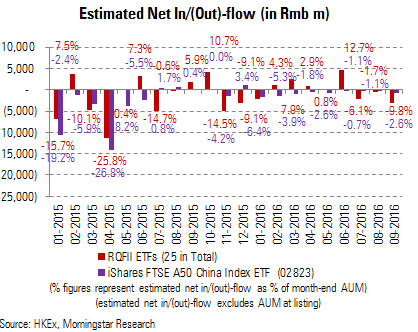

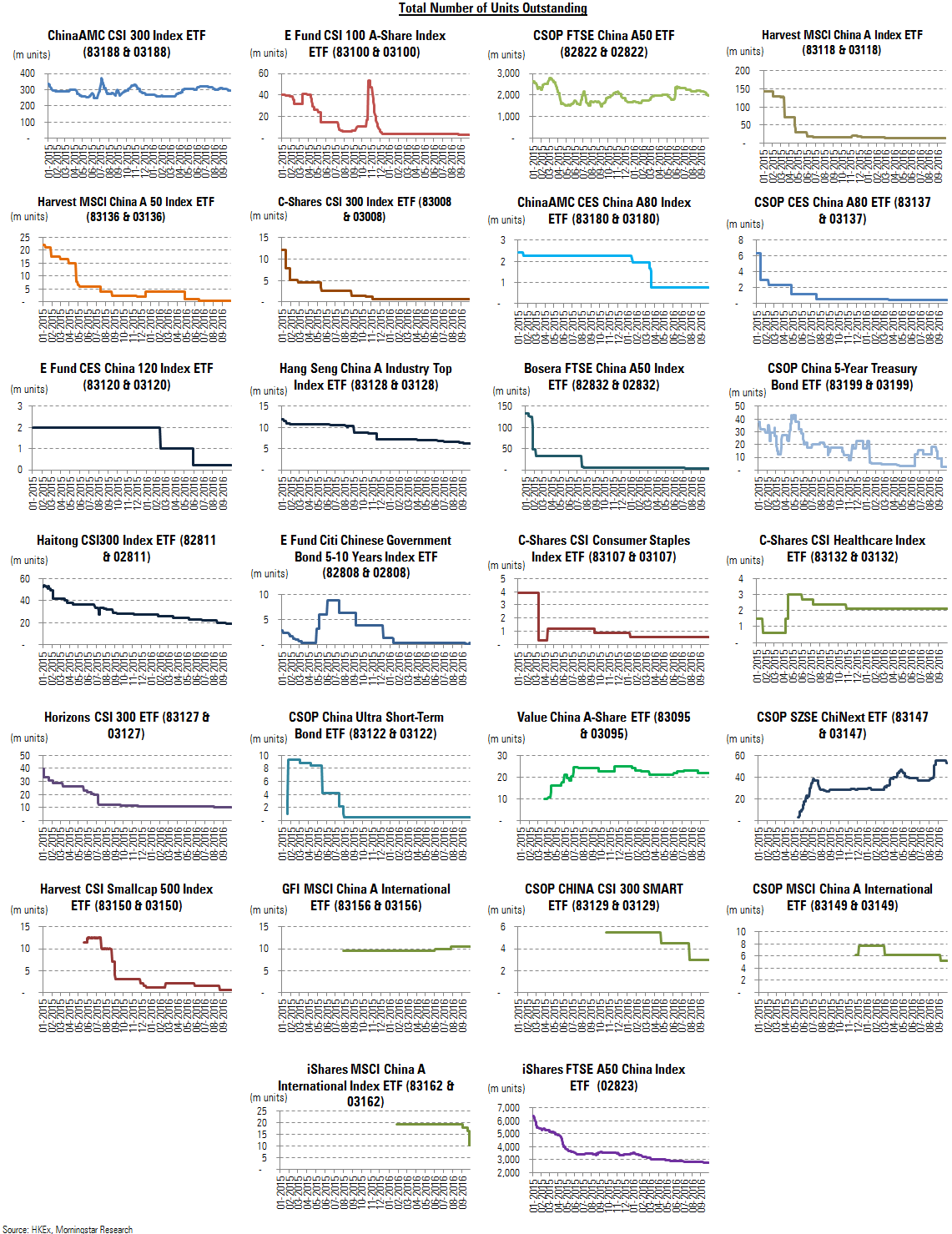

RQFII ETF Watch – Net Outflows in September Totaling Rmb 3.1 billion

• In September, RQFII ETFs in Hong Kong recorded estimated net outflows of Rmb 3.1 billion (9% of beginning AUM and 10% of ending AUM). This compares to Rmb 0.6 billion of estimated net outflows in August. We estimate YTD total net inflows of Rmb 1.1 billion as of 30 September 2016.

• The majority of the net outflows during the month came from the CSOP FTSE China A50 ETF (82822 & 02822), estimated at Rmb 1.9 billion, followed by the CSOP China 5-Year Treasury Bond ETF (83199 & 03199), estimated at Rmb 0.7 billion and the ChinaAMC CSI 300 Index ETF (83188 & 03188), estimated at Rmb 0.4 billion.

• The largest A-Share ETF by AUM in Hong Kong, iShares FTSE A50 China Index ETF (02823) continued to record net outflows in September, estimated at Rmb 0.7 billion. This compares to estimated net outflows of Rmb 0.3 billion in August. As of 30 September 2016, the YTD total net outflows from the iShares FTSE A50 China Index ETF are estimated at Rmb 6.9 billion.

New Launches and Listings

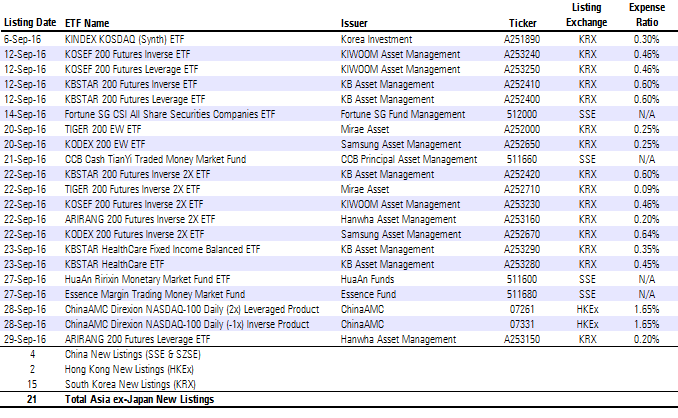

Korea Investment Lists a Synthetic ETF in Korea

On 6 September 2016, Korea Investment listed an ETF on the Korea Exchange, namely the Kindex KOSDAQ (Synth) ETF. The ETF aims to track the performance of the KOSDAQ Index by utilising swap.

KIWOOM Lists 3 Leveraged/Inverse ETFs in Korea

During the month, KIWOOM Asset Mangement listed three leveraged/inverse ETFs on the Korea Exchange. The ETFs track the inverse daily performance, twice the daily performance and twice the inverse daily performance of the F-KOSPI200 Index.

KB Lists 5 ETFs in Korea

During the month, KB Asset Management listed five ETFs, including three leveraged/inverse ETFs on the Korea Exchange. The leveraged/inverse ETFs track the inverse daily performance, twice the daily performance and twice the inverse daily performance of the F-KOSPI200 Index, respectivly.

On 23 September 2016, KB Asset Management listed two ETFs on the Korea Exchange, namely the KBSTAR HealthCare Fixed Income Balanced ETF and KBSTAR HealthCare ETF. The ETFs aim to track the FnGuide HealthCare Mix Index and the FnGuide HealthCare Index, respectively.

Fortune SG Fund Lists an ETF in China

On 14 September 2016, Fortune SG Fund Management listed an ETF on the Shanghai Stock Exchange, namely the Fortune SG CSI All Share Securities Companies ETF. The ETF tracks the CSI All Share Investment Banking & Brokerage Index.

Mirae Lists 2 ETFs in Korea

During the month, Mirae Asset Management listed two ETFs, including one leveraged/inverse ETF, on the Korea Exchange. The ETFs track the performance of the KOSPI 200 Equal Weighted Index and the twice the inverse daily performance of the F-KOSPI 200 Index, respectively.

Samsung Lists 2 ETFs in Korea

During the month, Samsung Asset Management listed two ETFs, including one leveraged/inverse ETF, on the Korea Exchange. The ETFs track the daily performance of KOSPI 200 Index and twice the inverse daily performance of the F-KOSPI 200 Index, respectively.

CCB Principal Lists a Money Market Fund in China

On 21 September, CCB Principal Asset Management listed a money market fund on the Shanghai Stock Exchange, namely the CCB Cash TianYi Traded Money Market Fund.

Hanwha Lists 2 ETFs in Korea

During the month, Hanwha Asset Management listed two ETFs on the Korea Exchange. The ETFs aim to track twice the inverse and twice the daily performance of F-KOSPI 200 Index, respectively.

The listing of the ETF and other ETFs listed by Samsung, Mirae, KB, KIWOOM and Korea Investment put the total number of ETFs in Korea at 240.

HuaAn Funds Lists a Money Market Fund in China

On 27 September 2016, HuaAn Funds Management listed a money market fund on the Shanghai Stock Exchange, namely the HuaAn Ririxin Monetary Market Fund ETF.

Essence List an ETF in China

On 27 September, Essence Fund Management listed a money market fund on the Shanghai Stock Exchange, namely the Essence Margin Trading Money Market Fund ETF.

The listing of this ETF and the other ETFs listed by Fortune SG Fund, CCB Principal and HuaAn Funds put the total number of ETFs in China at 140.

ChinaAMC Partners with Direxion and Lists a Pair of Leveraged/Inverse Products in Hong Kong

On 28 September 2016, ChinaAMC, as manager, lists a pair of leveraged/inverse products on the Stock Exchange of Hong Kong. ChinaAMC appointed Rafferty Asset Management, manager of the Direxion ETFs in the U.S., as the investment adviser for these ETFs. The pair of leveraged/inverse products track the 2x and -1x daily performance of the NASDAQ-100 Index, respectively.

These are the fourth pair of leveraged/inverse products listed in Hong Kong, and put the total number of ETFs and leveraged/inverse products in Hong Kong at 188 (146 ETFs and 42 multiple counters).

List of ETFs Launched in September 2016

.png)