Step Into the Time Machine

In case you hadn’t noticed (unlikely), Tesla’s (TSLA) stock has levitated. Over the past 12 months, it has gained a cool 808%. If Tesla’s stock continues to increase at that rate, the company will become worth more than all other publicly traded businesses in the world, combined, by autumn 2022. A global equity-index fund would consist of 50% Tesla, 50% everything else!

That probably won’t happen (although with Tesla, one seemingly never knows). The stock’s performance does raise the question, though: How speculative is Tesla’s price? Is the assessment of Tesla’s business prospects unprecedented, or have we experienced such optimism before with other wunderkind companies?

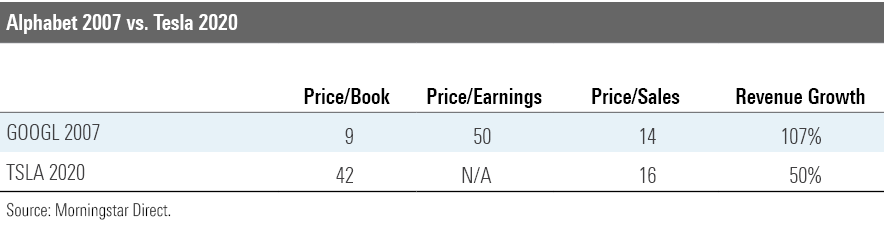

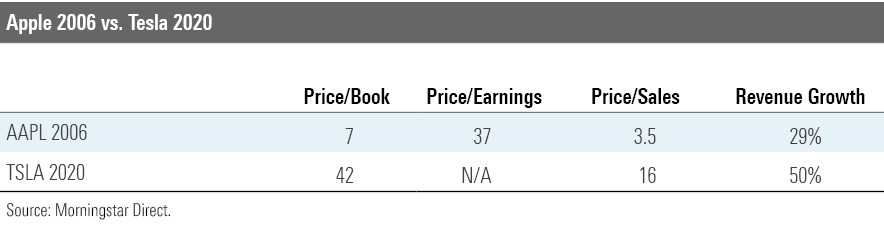

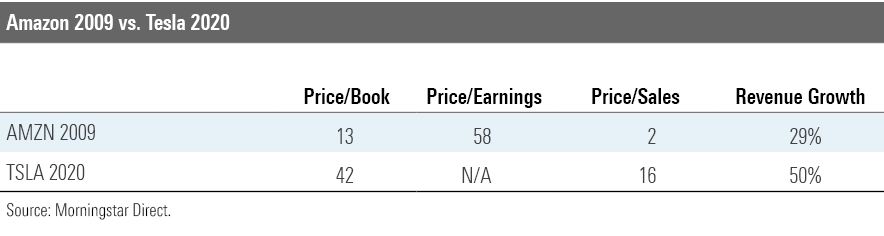

Not long ago, three famous businesses were the same size that Tesla is today: Alphabet (GOOGL), Apple (AAPL), and Amazon.com (AMZN). Let’s see how those firms were valued at those times. For each company, I show its stock’s price/book, price/earnings, and price/sales multiples during the year when its inflation-adjusted revenues most closely matched those of Tesla, along with the company’s five-year revenue growth. Tesla’s current figures are shown for comparison.

Alphabet

Alphabet in 2007 was clearly cheaper than Tesla is today. Alphabet’s price/sales ratio was only moderately below Tesla’s level, but its price/book ratio was much lower. In addition, Alphabet had meaningful profits, which traded at a relatively modest P/E ratio of 50--a steep multiple for most companies but not for one growing as rapidly as Alphabet. In contrast, Tesla has just begun to turn a profit.

(Morningstar calculates Tesla’s trailing P/E ratio as 1,111. I report that amount as “not applicable” because price/earnings multiples that are derived from tiny denominators are misleading. The company’s forward P/E ratio, generated by using its expected profits over the next four quarters, is a more realistic 125.)

Alphabet operates in a more lucrative industry. Tesla spends 80% of its revenues on cost of goods sold, which is par for the course for automakers. (Toyota (TM) is at 75%). Alphabet spends just under 50% on its cost of goods sold. All things being equal, it’s cheaper to peddle electronic services than items constructed from metals, plastics, and rubber.

Apple

A better benchmark is Apple. As with Tesla, Apple sells tangible products, which increases its cost of goods sold. (Apple’s costs of goods sold is 62%, which places it well ahead of the automobile industry but behind the leading Internet firms.) As with Tesla, Apple has built a dominant brand through design, functionality, and marketing. Both companies command significant pricing power.

The valuations, though, are not close. In 2006, Apple’s price/book and price/sales multiples were roughly one fifth of Tesla’s, while its P/E ratio was only about double that of the overall stock market. At the time, there were widespread doubts that Apple would be able to sustain its success by constantly enhancing its product line. Plainly, those same concerns do not afflict Tesla.

In its favor, Tesla is somewhat earlier in its corporate cycle, posting a 50% revenue-growth rate over the past five years, as opposed to Apple’s 2006 mark of 29%. Whether Tesla can maintain that blistering pace is, of course, open to question. The company’s revenue-growth rate has dropped each year since 2015, when it was 103%. As Warren Buffett has long stated, keeping the same growth rate as a company expands is very difficult. (This has been no false modesty on Buffett’s part, as Berkshire Hathaway's (BRK.B) excess returns have eroded over time.)

Amazon

Amazon isn’t a particularly apt yardstick. The company is a distributor that prospers through ubiquity (the network effect) and by acquiring a reputation for excellent service, while Telsa is a manufacturer that thrives by creating product demand. However, any list of previous glamor stocks would be incomplete without mentioning one of the three companies in the world to boast a market cap exceeding $1 trillion.

(The other two are Apple and Microsoft (MSFT). I omitted a comparison with Microsoft because it overlapped with Alphabet’s.)

In broad terms, Amazon’s 2009 valuation matched that of Apple’s three years prior. Once again all three price indicators landed far beneath those of Tesla, and once again Tesla’s revenue-growth rate was appreciably higher. Apple and Amazon occupy different industries, and have succeeded for different reasons, but during the latter half of the 2000s their stocks were similarly priced.

And We're Back

The bad news for Tesla shareholders is that, when their companies were at similar stages, the stocks of Alphabet, Apple, and Amazon were considerably cheaper. The good news is that, even at triple the price, shares in each of those stocks would have performed very well. Paying 3 times the going price for Apple entering 2006 would have yielded a 17.2% annualized return. Disappointing when contrasted with Apple’s actual gain of 26.7%, but nonetheless quite pleasant.

This analysis takes for granted that Tesla’s business will enjoy extraordinary success. My comparisons have been with the stock market’s few great winners, not with the many not-great losers that once were household names but have since faded into obscurity. (Remember AOL?) My premise is that Tesla will continue to thrive, albeit perhaps not as spectacularly as its most fervent admirers would believe. This article therefore provides the bull case.

The upshot is that Tesla’s stock price is not necessarily crazy, although certainly ahead of itself. If Tesla can progress from leading among electric-car manufacturers to spearheading robotaxi development--as is assumed by Tesla’s proponents--then the company should eventually be able to justify its $400 billion market cap, which is more than double that of Toyota.

So, the stock price is not entirely crazy. But neither is it compelling. Morningstar’s Tesla analyst, David Whiston, assigns the company’s shares a fair value of $173, as opposed to its current market quote of $445. That sounds about right to me. The stock could justify its valuation, but that would not be the way to bet.

This article is published on 2020/9/21 on www.morningstar.com.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

.png)