It's a year since the world looked on with bated breath as the Chinese government made the radical move to put Wuhan province, and its million of residents, in lockdown. But the bold move meant the country was the first to begin to recover from the Covid-19 pandemic - at least in economic terms.

So, what did 2020 look like for this powerhouse economy? We look at the China story of in five charts:.

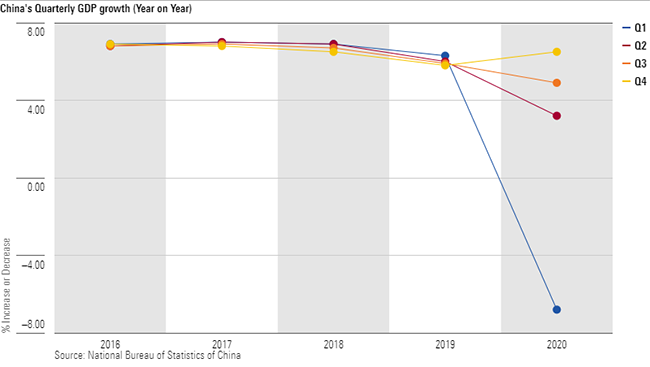

1. GDP Comes Back Strongly

China’s economy grew by 2.3% last year, making it one of the only large economies in the world to expand in 2020. Fourth quarter figures were particularly impressive, as the economy grew 6.5% year on year, returning the country to growth levels last seen before Covid-19.

In contrast, the US economy is expected to have contracted by 3.6% in 2020 and the UK by 11%. Our chart shows how quickly the Chinese economy snapped back to pre-coronavirus levels after the slide at the start of the year.

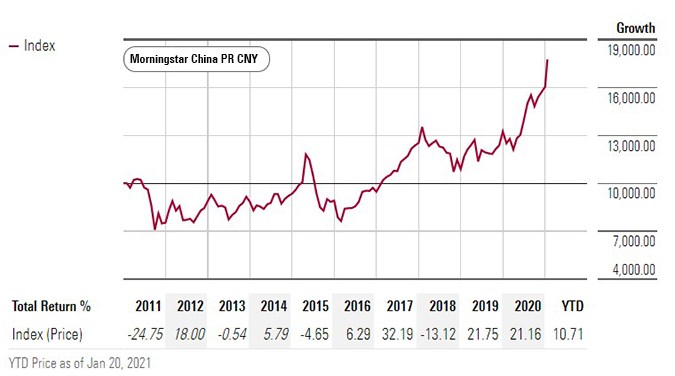

2. 2020 Crash Makes Little Impact

Despite the seismic impact of last year’s events on the world, the chart for the benchmark Shanghai Composite index barely registers the global stock market sell-off. The index bottomed out at 2,660 points on March 23 but had recovered to nearly 3,500 points by July and closed the year around the same level.

China stock markets were some of the best performing in the world in 2020: the Morningstar China Index was up 21.16% in local currency terms, ahead of US indices like the S&P 500, which closed 2020 with a gain of 16%. (In dollar terms, the index was up nearly 30%).

For the Chinese market, price declines in 2011 and 2018 made a far bigger impact. As we will see, many top-rated China funds managed to beat the index comfortably last year.

3. China Bond ETF is a Best Seller

2020 saw a big shift of investor money into passive products like index funds and ETFs. Within that, China onshore bonds were a surprise entry into the five most popular ETF categories in 2020, attracting €4.7 billion (the top category, Commodities – Precious Metals brought in €13 billion).

“The purchases have been driven on the one hand by the strength of the Chinese currency and on the other by extremely attractive yields,” says Morningstar’s Valerio Baselli. Indeed, the majority of the flows into the Remnimbi Bond – Onshored category were accounted for by the iShares China CNY Bond ETF (CNYB), the most popular ETF across Europe in 2020. China equity ETFs also attracted €1.78 billion in net inflows last year.

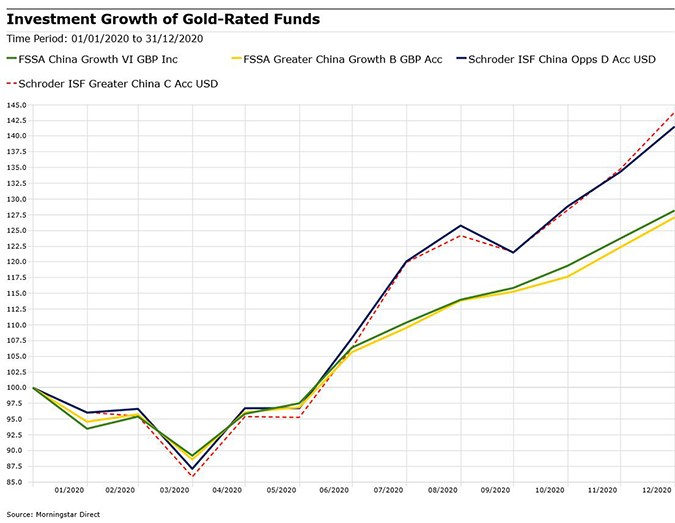

4. Gold-Rated China Funds Outperform

The shape of the performance graph for Gold-rated China funds is similar to that of the index, in that a slump at the start of the year is followed by sustained rally. But the four funds with the highest Morningstar Analyst Rating have beaten the index’s 21% gain by a decent margin.

Schroder ISF Greater China is the best performing fund with a Gold Morningstar Analyst rating, with a gain of almost 40%. But it was beaten by two Silver rated funds: investment trust JPMorgan China (JCGI) rose 83% in price terms last year, while open-ended fund JP Morgan China returned 65%.

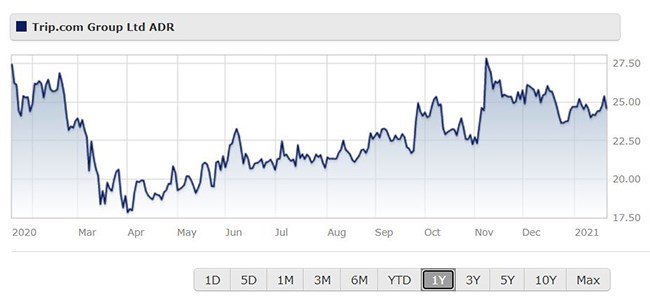

5. China Travel Giant Had a Tough Year

Not all China stocks had an amazing year though. China’s largest online travel agency Trip.com (TCOM), which is listed in New York, had a rougher ride in 2020 amid travel restrictions within China and then across the world.

Its share price graph for 2020 reflects this volatility, with a big slide in late February and March. This was followed by a rapid recovery when China – unlike many countries in the world at the time – loosened restrictions for domestic travel.

Morningstar analyst Dan Baker says the near-term story of domestic recovery is now largely priced in to Trip’s shares, which rallied towards the end of the year. But overall the shares are still undervalued compared to their fair value of $40. Trip.com's international business has great potential to expand in the future, Baker says, as the company already has such a large market share in China.

.png)