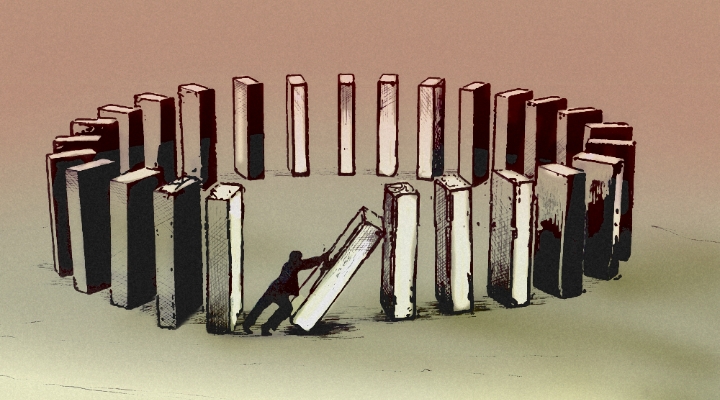

If you’ve been the victim of watching “a day in my life” compilation videos from overly productive influencers talking about their 5-to-9 after their 9-to-5 job while in pajamas on your couch eating popcorn for dinner after your own 9-to-5, you may be entitled to financial compensation. Ok, not really, but there is a way you can compensate yourself: with a side hustle.

Whether the visual explained above is exactly something I’ve experienced is not why we’re here. We’re here to ask reddit about hustle culture, specifically: Do I need a side hustle?

There are a few reasons to pick up a side hustle, such as:

- To save up for a dream house, vacation, outfit, or concert.

- To bolster savings if a dream house, vacation, outfit, or concert is not on the horizon (yet).

- To steadily transition your lifestyle from full-time employment to retirement.

- To spend free time in a way that will literally pay off.

- To build an emergency fund.

- To pay off debt.

The list goes on. And so do these ideas from Reddit’s r/personalfinance community.

The Best Side Hustles, According to Reddit

Content warning: If you thought a side hustle was easy and low maintenance, these comments may burst your bubble.

- “When I was just hustling and trying to make extra money, I was doing door dash and Uber eats. Would pull out of work, sign into doordash and drive around for like 3-4 hours 4 days a week. Ended up making close to 1500 a month just from that.” u/Green-Instance-2727

- “Reffing/umpiring kids sports. In my area we average 20-30 an hour (so ~200$ on an 8 hour day). It's not terrible if you don't mind being yelled at.” u/BillBob13

- “I flip furniture for extra money and I find it fun. I’m a stay at home mom and bring my kids along to pick up furniture. They help me clean it and then we sell it. I bring in 500-3000$ a month depending.” u/WrightQueen4

- “Selling plasma probably gets you $250-300/month if there's a place nearby, and you can sit & listen to podcasts, read, or do (quiet) work while there.” u/scrapman7

- “Monetizing a hobby is a great side hustle because you are killing two birds with one stone and it will feel a lot less like a second job. I had a buddy that would go around the neighborhood (huge subdivision) and pick up old fence panels or other scrap wood when someone didn't need it. He would then build theses coolers for your patio out of the old wood. I think he told me he was selling about $2500/worth a month doing the carpentry he liked to do as a hobby.” deleted user

- “If you have a degree, online tutoring is a decent option. Especially if you have math, science, or some type of language background. A friend of mine does in- person reading and ACT prep tutoring, in a small office she shares with her family business, for nominal rent. She is doing this while finishing an online degree program so she has a lot of flexibility.” u/1955photo

4-Steps to Getting Yourself a Side Hustle

Step 1 - Ask Yourself: Can You Afford a Side Hustle?

First, ask yourself if you can afford the costs of a side hustle: your time. And while you’re at it, here are a few other things to consider, too:

- Do I actually want to take up a second job?

- Do I need a side hustle to reach my financial goals?

- Do I just need to re-evaluate my budget and expenses?

“Regular budget shortfalls or rising inflation can be concerning but aren't necessarily signs of needing additional income,” writes Morningstar Canada’s senior editor Andrew Willis. “For example, they could be caused by forgotten or unnecessary expenses, such as old subscriptions you no longer use, and potentially offset by other assets unaccounted for.” If you need more guidance or an extra 2 cents, it could be worth reaching out to a financial planner to help you understand your current financial situation.

Step 2 - Ask Yourself: What Are You Good At?

Second: Figure out what you’re good at. Or rather, what you can do well without getting overwhelmed, bored, or resentful of what talent or service that gave you the idea in the first place. Re: costs of a side hustle may also include your joy.

Some other common side hustles include:

- Babysitting

- Dog sitting or dog walking

- Housesitting

- Taking online surveys

- Freelancing

Step 3 - Ask Yourself: How Much Do You Owe in Tax?

Third: Let’s say the cash is already starting to flow at this point. Whether you’ve settled on online tutoring or rehabbing thrift store furniture, you need to report your income correctly. More money, more taxes.

Step 4 - Ask Yourself: Have You Scheduled Check-Ups?

Lastly: Check in with yourself and your progress on your financial goals as you continue your side hustle. As with all things, you need to schedule regular check-ups – for your side hustle, as well as your financial health. This is a very important task, as Morningstar’s director of personal finance Christine Benz explains.

“Investors often make the mistake of checking up on their portfolios too frequently, or worse yet, only after big market moves, when they're most inclined to make rash decisions. To help avoid that pitfall, schedule regular check-ups in advance. For most people, one comprehensive portfolio review per year is plenty, and much better than obsessing on a daily basis. Year-end--ideally around Thanksgiving, before the holidays gear up--is a good time to conduct your annual portfolio review, because you can still make adjustments for the year,” she says.

And above all, don’t compare yourself to the influencers, your peers, or anyone else. This is your financial journey—you set the course and the costs.

.png)