:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JAPGX3NBJBEALEDTLYEQEDRCZA.png)

After a losing streak in 2022, video game stocks have been making steady gains throughout 2023. Despite their rising prices, some of the biggest, highest-quality game stocks are still trading at attractive prices. These include some of the biggest names in the industry, such as Nintendo (NTDOY) and Roblox (RBLX).

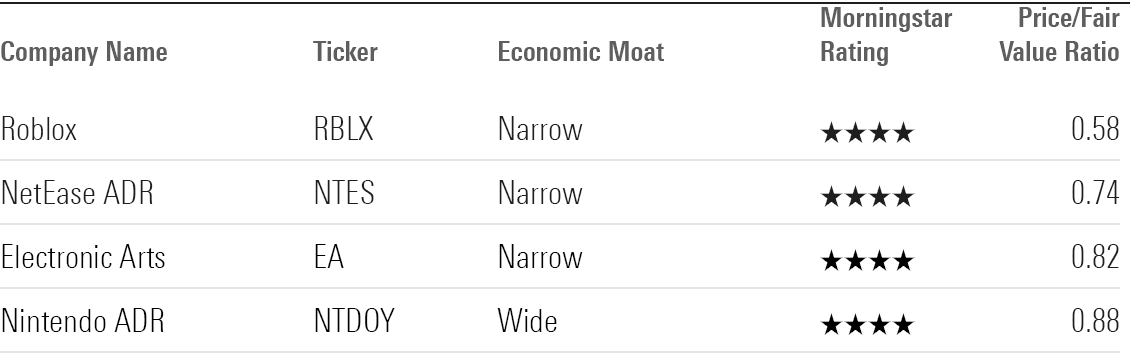

To look for undervalued gaming stocks, we turned to the Morningstar Global Electronic Gaming and Multimedia Index, which tracks companies that develop or publish video games and other multimedia software applications, including personal computers, consoles, cellphones, tablets, and other portable media players.

At the start of 2022, video game stocks saw strong returns stemming from the COVID-19 pandemic. During 2020 and 2021, many people found themselves with extra time on their hands and were looking for distractions, leading to an uptick in interest in gaming. But that interest didn’t last for those investing in video game stocks. With the world opening up throughout 2022, gaming stocks lost value as people had less free time.

As of Aug. 8, 2023, the video game index gained just 3.9% for the trailing 12-month period, while the broader stock market rose 9.8% as measured by the Morningstar US Market Index. For the calendar year 2023, the video game index is up 11.9% while the broader market has gained 18.1%.

Undervalued Gaming Stocks

We looked for the most undervalued stocks in the game index by screening for those that currently carry a Morningstar Rating of 4 or 5 stars. We also looked for stocks with Morningstar Economic Moat ratings, meaning they have durable competitive advantages that are expected to last at least 10-20 years. Historically, stocks with moats and low valuations tend to outperform over the long term. Of the 57 stocks in this index, only nine are covered by Morningstar analysts, and of these, four were undervalued as of Aug. 8, 2023.

- Roblox

- NetEase (NTES)

- Electronic Arts (EA)

- Nintendo

The most undervalued stock is Roblox, trading at a 42% discount to Morningstar’s fair value estimate. The least undervalued is Nintendo, trading at a 12% discount. NetEase and Nintendo are based outside the United States, but U.S. investors can buy the stocks as American depositary receipts.

Undervalued Video Game Stocks

Roblox

- Fair Value Estimate: US$ 60.00

“Roblox operates an online video game platform that lets gamers create, develop, and monetize games for other players. The firm offers developers a hybrid of a game engine, a publishing platform, online hosting and services, a marketplace with payment processing, and a social network. Unlike a full-priced AAA title, there is no entry cost to try Roblox or the vast majority of user-developed games. Thus, to drive booking growth and keep the Roblox model churning along, a new user must purchase and spend Robux, the platform’s tender.

“Roblox heavily benefited from the stay-at-home restrictions at the start of the pandemic with very impressive top-line growth, even more so than its peers. It expanded its user base from 19.1 million daily active users, or DAUs, in the fourth quarter of 2019 to 65 million in the second quarter of 2023. We project that the combination of popular games and a large user base will attract more users. Additionally, we expect that the firm will be able to further increase its penetration in non-U.S. markets. As a result, we believe growth will be slower than during the pandemic, but that DAUs will exceed 108 million in 2027.

“In the longer term, we assume the firm continues to invest in adding new features to keep both developers and teenage gamers engaged with the Roblox platform. While an all-encompassing metaverse may be far from realization, we think Roblox’s steps toward a metaverse will help the platform hold on to users and developers as they age.”

—Neil Macker, senior equity analyst

NetEase ADR

- Fair Value Estimate: US$ 146.00

“NetEase, which started as an internet portal service in 1997, is a leading online services provider in China. Its key services include online/mobile games, cloud music, media, advertising, email, live streaming, online education, and e-commerce. The company develops and operates some of China’s most popular PC clients and mobile games, and it partners with leading global game developers such as Blizzard and Mojang (a Microsoft (MSFT) subsidiary).

“NetEase has now become the second-largest mobile game company in the world. The firm owns one of the most well-known massively multiplayer franchises in China, Fantasy Westward Journey. Over the past decade, NetEase has capitalized on the industry shift toward mobile and now focuses on a mobile-first approach to developing innovative, high-quality, long-cycle games.

“Over the foreseeable future, we expect NetEase to continue to leverage its in-house research and development team and user data to develop next-generation games. Like its global peers, NetEase maintains a high level of profitability for its gaming business thanks to stable revenue from core titles and the steady development of new franchises. We believe the firm is positioned to not only continue capitalizing on the success of Westward Journey titles but also keep diversifying its revenue into new franchises.”

—Ivan Su, senior equity analyst

Electronic Arts

Fair Value Estimate: US$ 150.00

“Electronic Arts is one of the world’s largest third-party video game publishers. It owns some of the most well-known game franchises, including FIFA, Madden, and Battlefield. We believe the firm will consolidate its leading position by developing compelling new versions of its existing franchises, creating new ones like Apex Legends, and acquiring established ones like F1 from Codemasters. We expect EA to continue to benefit from the increased availability of current-generation consoles, the ongoing revitalization of PC gaming, and the growth in the mobile gaming space.

“Like its peers, EA has benefited from the shift within the industry toward a bifurcated market consisting of major AAA blockbuster titles on one side and smaller independent games on the other. EA’s primary competition remains other large third-party publishers, such as Tencent, Take-Two, and Activision, as well as first-party publishers Sony SONY, Nintendo, and Microsoft. EA is also a large publisher on mobile platforms. We expect the company to continue using its stable of franchises and licenses to create new games, particularly in the free-to-play space.”

—Neil Macker, senior equity analyst

Nintendo ADR

Fair Value Estimate: US$ 12.52

“Nintendo has been in the games business for 40 years, and we believe the franchises it has established throughout its history, including Super Mario Bros., Pokemon, The Legend of Zelda, Mario Kart, and Animal Crossing, will help the company generate excess returns over the long term. Over the past decade, Nintendo has been focusing on actively leveraging its characters on nongaming platforms to increase user touch points, which we believe has successfully enhanced its brand power. Nintendo’s June-quarter sales and operating income, reported Aug. 3, reached historical highs due to the contribution of The Super Mario Bros. Movie and robust sales of first-party games, even though the Switch console is nearing the end of its lifecycle. We view this strong performance as evidence of the success of Nintendo’s strategy. We believe its shares are currently slightly undervalued.

“We believe Nintendo’s fans will increase as people are able to enjoy its characters across various media, and that the success of the Switch proves the company can attract new fans by leveraging its characters and preparing an attractive game pipeline. Future challenges include monetizing its characters efficiently in its non-console business, its re-entry to the greater China market, and adapting to the diffusion of cloud gaming. We nevertheless believe the company’s ability to deliver fun games is intact.”

—Kazunori Ito, director

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BI7UX2RGJBHCBOP7VRZ3ZOYBVM.jpg)

.png)