Kate Lin: The ongoing turbulence in Chinese stocks raises important questions about the performances of funds investing in both Asian stocks and bond assets. This brings us to today's topic. What are the top funds that can navigate through these challenging times and potentially generate alpha? We're asking our manager research analyst Sam Hui. Sam, do you have any funds in mind?

Sam Hui: Hi Kate, Yes, let me talk about the Schroder Asian Asset Income Fund and the First Sentier Bridge Fund today. The First Sentier Fund targets 50/50 allocation to equity and bond. We have strong conviction in equity manager Martin Lau and his team. They have delivered solid long-term performance across various Asia equity strategies. They focus on bottom-up stock picking and they see quality growth companies at reasonable prices. The fixed income sleeve takes an overall strategy volatility and offers some yields.

In comparison, the Schroder fund deploys flexible asset allocation. The team actively manages exposure to equity and bonds between 30 and 70%, in order to navigate different market environments. The equity sleeve here has a stronger dividend focus and that supports the fund to generate income. Overall, we like the structured investment processes and the team is well-resourced.

Risk and Return Measures

Lin: Well most recently this correlation between stocks and bonds were very unexpected and over the past five years the market is also very challenging. So how did these funds perform?

Hui: I think it's good to look at 2022 when the market saw one of its worst sell-off. The average Asia multi-asset fund lost close to 20%. The two funds we discussed did better, losing roughly 13 to 14%. But, of course, returns is just one part of the story, and it's hugely important that we look at risk as well.

while that of First Sentier Bridge were in line with peers. But how to link things up and measure risk-adjusted performance? We can look at Sharpe Ratio. It is calculated as excess returns over risk-free rate divided by standard deviation of the excess returns. Both funds did better than peers in this regard. For investors who care more about the downside, Maximum Drawdown is a useful metric. It tells you the maximum loss the fund experiences in a given period. The figure was 22% for Schroders fund and 28% for First Sentier fund and over the last 5 years, versus the average peer’s 30%.

Based on standard deviation, the Schroder fund returns were more stable than the average peer, while that of the First Sentier fund was in line with peers. So, how to link things up and measure risk-adjusted performance? We can look at Sharpe ratio. It is calculated as excess return over risk-free rate divided by standard deviation of the excess returns. Both funds did better in this regard than the average peer.

For investors who care more about the downside, maximum drawdown is a useful metric. It tells you how much the fund has experienced the maximum loss in a given period. The figure for the Schroder fund was 22% and the figure for the First Sentier fund was 28% over the past five years. For the average Asia multi asset peer that will be 30%.

Equal Weight? 60/40? Or Flexible Mix?

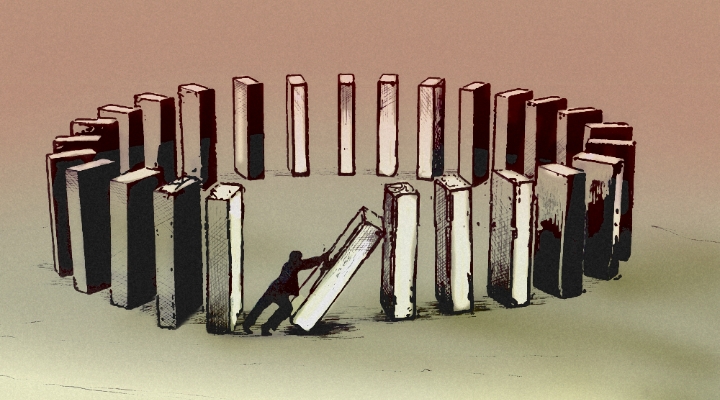

Lin: And apart from risk metrics, we also want to understand how fund managers mix between stocks and bonds. The question is whether an equal weight traditional 6040 or flexible allocation is better.

Hui: This is a great question. I would say there is no single best design. Flexible allocation may allow you to better navigate the market environments. For example, having more equities in 2020 may be helpful, while having more bonds in 2022 would be beneficial. The point is you need to have the capabilities in making these allocation calls. Otherwise, you may end up suffering from poor market timing.

Schroder has a team of roughly 10 in Asia dedicated to asset allocation and that supports their flexible allocation model. For the First Sentier Bridge fund, the portfolio manager’s expertise lies in equities and bonds so it's sensible for them to focus on managing the underlying sleeve while keeping the asset mix at 50/50.

There are also funds that target 60/40. They will have higher expected returns, but of course, also higher risk. It really depends on the end investor's needs and risk tolerance when deciding which strategy is suitable. There is no single strategy that can fit all investors.

Lin: Wonderful, Sam, thank you so much for your time. For Morningstar, I'm Kate Lin.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DSZYYKGIYFHBRCV5ODLKEA4PWU.jpg)

.png)

.jpg)