After spending close to a decade of wandering in a desert of low interest rates, the U.S. Federal Reserve’s rate-hike spree (including its most recent 0.25% hike on July 26) over the last 18 months has income flowing like Champagne on a Summer Friday. And there’s arguably no better oasis for conservative investors to quench their thirst for income today than ultrashort-term bond exchange-traded funds.

This hasn’t been the case for a long time—before the Fed began hiking in March 2022, plain-vanilla U.S. Treasuries with a maturity of one year or less provided pithy yields that left risk-aware investors yearning. This was part of the reason that buying longer-dated bonds or bonds with a higher risk of default became the hot trend for several years. They were the only way to get a drop of income in fixed income without reaching into esoteric deals (some investors chose alternatives, or even cryptocurrency, but that’s a different story). Ultra short-term bond yields have been soaring recently, especially relative to their longer-duration counterparts.

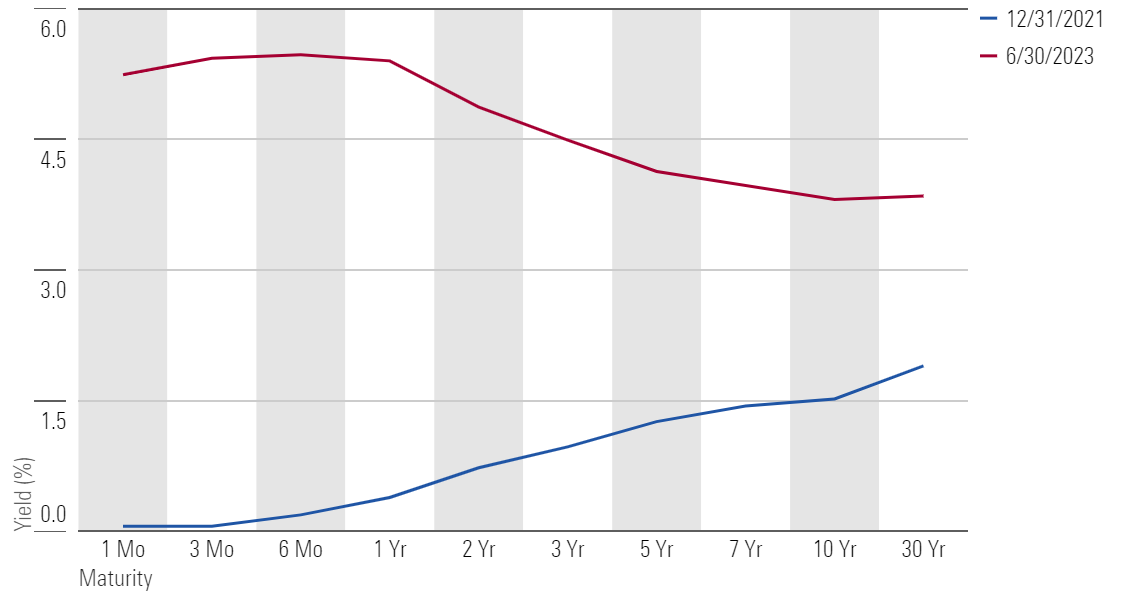

Changes to U.S. Yield Curve

Indeed, yields on the shortest end of the curve are so high that they’ve surpassed what an investor can get by lending money for longer periods, a phenomenon bond aficionados call yield inversion. And while trying to time the Fed’s next move has proved a fool’s errand, most investors right now believe these hefty yields are here to stay, at least for a bit. The CME FedWatch Tool, which tracks the probability of changes to the Fed’s target rate, forecast a roughly 95% probability that ultrashort yields would be the same or higher at the end of the year in the wake of the Fed’s July 26 hike.

How to Measure a Bond ETF’s Income

While it’s easy to see the shape of the U.S. Treasury yield curve, it’s not as intuitive to find the yield on a bond ETF. Here’s a guide to some of the different yield calculations, when they should be used, and some context on current market conditions.

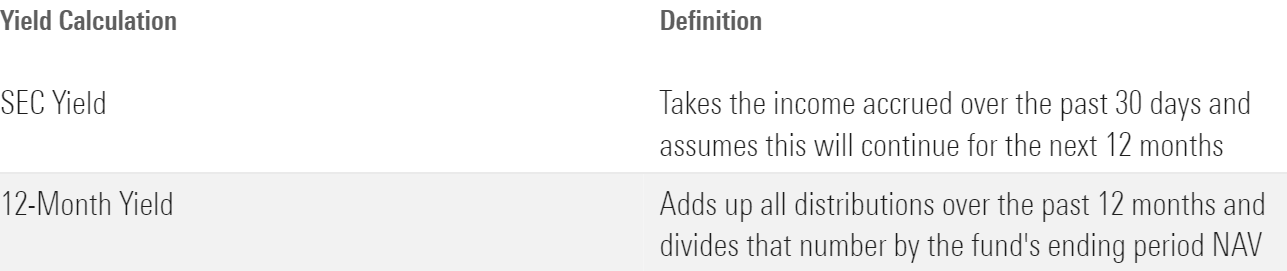

Yield Definitions

SEC Yield

The SEC yield is calculated by taking the income that has accrued over the past 30 days and assuming this will continue for the next 12 months. The main draw of this calculation is that it gives an accurate picture of the current income of the fund. This methodology is standardized by the SEC and allows for fair comparisons between funds, but it doesn’t capture how a manager’s recent portfolio adjustments or recent changes in bond prices might affect a fund’s future yield.

12-Month Yield

The 12-month yield adds up all the distributions over the past 12 months and divides that number by the fund’s ending period net asset value. This gives an indication of the income investors actually received in the fund, not just a hypothetical calculation of the future return. If a fund has an inconsistent or volatile income stream, the 12-month yield will smooth out the distributions into a more realistic expectation of total income for the next year. However, if interest rates rose or fell during the previous year, the income received 11 months ago will be higher or lower than the current portfolio and could provide an inaccurate picture of what investors can expect going forward.

Which Is the Better Data Point?

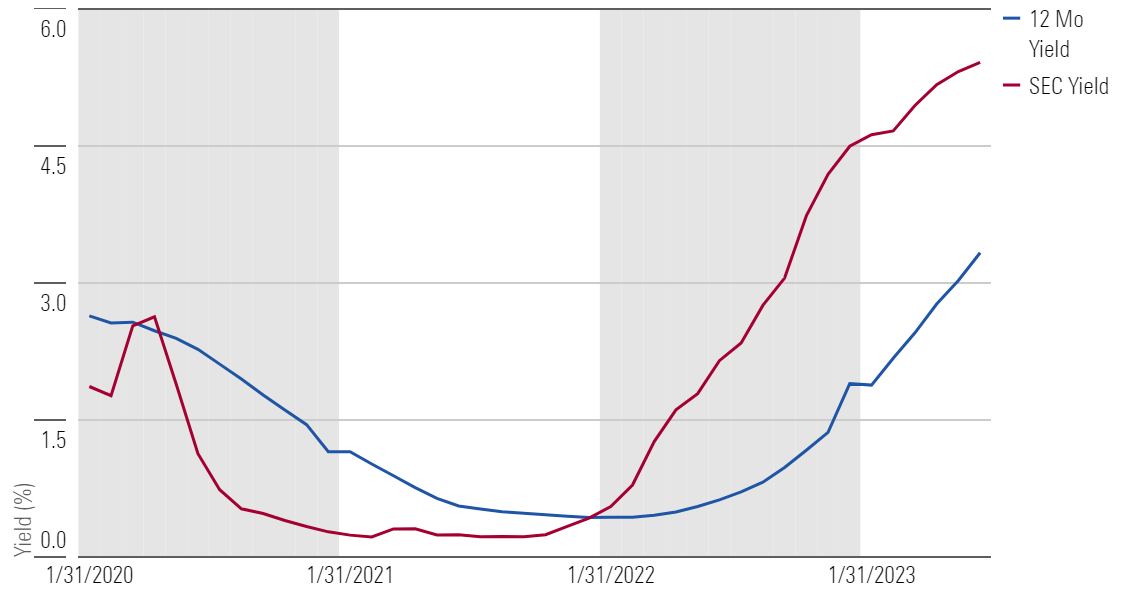

It depends! No single yield calculation is perfect, so instead of thinking one is better than the other, these two figures can be used in tandem. Because 12-month yield measures the actual distributions provided by a fund over the past 12 months, it is the more “concrete” figure but also more backward-looking. SEC yield, on the other hand, can be used to approximate what a fund’s income will be in the future, with the caveat that a fund’s income can change based on market moves or portfolio adjustments. Taken together, 12-month yield shows what a fund’s income has been, whereas SEC yield shows where it may go. The chart below gives a demonstration of this phenomenon:

Pimco Enhanced Maturity ETF's Income

Over most time periods, Pimco Enhanced Short Maturity ETF (MINT) has seen its SEC yield “lead” its 12-month yield. When its SEC yield trends downward, its 12-month yield follows it down; conversely, when its SEC yield trends upward, its 12-month yield follows it up at a lag.

The Ultrashort Kings

If all this talk of yield has gotten you thirsty for income, the chart below shows some of our top analyst-rated picks for ultrashort ETFs with attractive income potential.

Ultrashort Kings

You’ll notice that the SEC yields for all the funds on the table are higher than their 12-month yields, showing that these strategies yield more right now than they have over the previous 12 months. Yet, as the deviations in the yields of the funds demonstrate, these are three compelling options that aren’t quite created equal:

Pimco Enhanced Short Maturity—along with its sustainability-focused cousin, Pimco Enhanced Short Maturity ESG (EMNT)—lead the pack with Morningstar Medalist Ratings of Gold. Jerome Schneider, supported by the considerable resources of Pimco’s short-term desk, leverage their firm’s considerable credit research expertise and detailed macro research considerations to parse for attractive relative value opportunities in short-dated debt. Although they aren’t afraid to explore opportunities in investment-grade corporate and securitized credit and make measured bets in non-U.S. debt, Schneider and team swear off more volatile fare like junk-rated debt and foreign currencies. MINT and EMNT largely sport the same deep research process and investment parameters, though EMNT emphasizes those issuers with improving-to-exemplary sustainability practices while excluding those that do not meet the firm’s environmental, social, and governance criteria.

JPMorgan Ultra-Short Income (JPST) earns a Silver Morningstar Medalist Rating off the back of its experienced managers and risk-aware approach. Lead manager James McNerny has led since the fund’s May 2017 inception, and he and his comanagers marry bottom-up recommendations from JPMorgan’s sizable credit research bench with top-down macro views generated by the firm’s broader group of fixed-income specialists when constructing the portfolio. Although McNerny and team dabble in investment-grade corporate and securitized credit, they are highly attuned to their investors’ liquidity concerns and maintain a hefty slug in cashlike instruments and other highly liquid fare.

Invesco Ultra Short Duration ETF (GSY) rounds out the pack with a Morningstar Medalist Rating of Bronze. Comanagers Joe Madrid and Marques Mercier make final positioning decisions after vetting security ideas from the firm’s seasoned global liquidity desk and while consulting with Invesco’s investment strategy team on their economic views. This mix of bottom-up and top-down recommendations is sufficient for the fund’s short-dated and risk-aware investment parameters. Madrid and Mercier’s experience in navigating the nuances of short-duration fixed-income markets, however, make this strategy a solid competitor in the space.

A Short Note on Risk

There is one final point of caution to consider before diving into an ultrashort bond ETF. The U.S. Bureau of Labor Statistic’s June job report showed that job growth remains steady, if unspectacular, leaving many Fed watchers believing that the U.S. Federal Reserve will once again elect to raise the federal-funds rate when the Federal Open Market Committee meets at the end of July. Credit ratings giant Fitch, for example, expects the Fed to keep hiking until it hits 5.75%, up from the current range of 5.25% to 5.50%. Although inflation does seem to be slowing down, continued rate hikes by the Fed could serve as a double-edged sword. Bond yields move inversely to bond prices, and while rate hikes might lead to higher yields, they may also cause at least temporary volatility for holders of ultrashort bond ETFs. Nevertheless, ultrashort bond ETFs have much less duration risk than longer-dated bond strategies and can also provide downside protection in periods of credit stress. All in all, income-interested investors trying to beat the summer heat ought to consider giving some attention to an ultrashort bond ETF.

Editor's Note

Jason Kephart, director, multi-asset ratings, contributed to this article.

.jpg)

.png)