Yields on long-term U.S. Treasury bonds—which serve as a benchmark for home mortgages and other key consumer and business borrowing rates—have risen to their highest level since October 2007.

The higher interest rates are weighing on individuals and corporates who need to pay back loans, but are rewarding bond investors and are making returns on a 60/40 portfolio more attractive, a stark contrast compared to way these portfolios performed in 2022. Morningstar’s research shows the classic balanced portfolio has delivered about a 7% return through the end of September this year.

Sylvia Sheng, global multi-asset strategist at JP Morgan Asset Management, thinks the 60/40 stock-bond allocation remains a good starting point to construct a portfolio. “We still don't think it's time to abandon the balanced portfolio yet,” says Sheng. Sheng’s research shows a 60/40 allocation is expected to annualize a 7% return over the next 10 years, “That means you can double your money in just over 10 years,” she says.

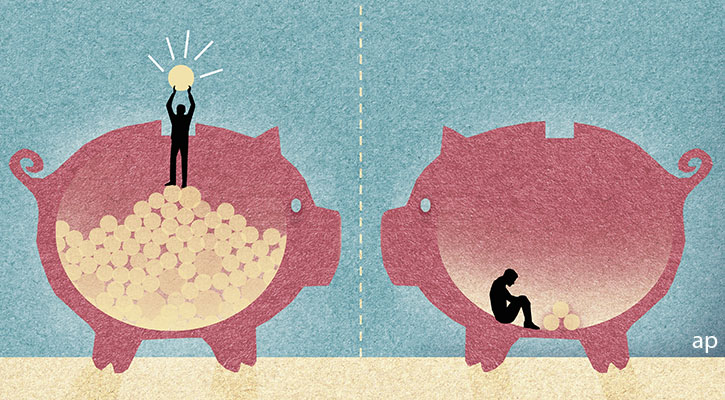

Out another way, if you invest $100 in a 60/40 portfolio today, you could earn $54 on top of the principal in the next decade after inflation. If you left the $100 in cash, you’d make $4 by 2033. “It is important for investors to extend out of cash because the prevailing cash rates are unlikely to continue, in our view,” Sheng adds.

The End of ‘Free Money’

For the next 10 years, an important theme for investors to note is the end of free money, which was one of the causes of higher inflation. “One of the themes this year for us is we are likely to see more two-sided risks in terms of inflation that really requires that inflationary hedge in your portfolio,” Sheng says.

After a decade of disinflation, she thinks investors should think about inflation in a more two-way direction. JP Morgan’s research identified the nine inflation drivers. There is only one factor that is expected to drive inflation lower: artificial intelligence and automation. The firm expects the development of AI to help companies widen their operational profit by lifting productivity while managing costs.

On the other hand, sustainability, which includes the adoption of renewable energy, requires a certain level of investment and adoption costs that could potentially drive inflation higher in the long run. JP Morgan also sees inflation expectations, income distribution, the changes in globalization or a more fragmented supply chain likely to drive inflation higher.

Sheng also thinks there is a structural shift in the market underway, moving away from ultra-easy monetary policy and indiscriminate bond purchase which lifted all asset prices, to one “where there’s the hard cost of capital, where the private sector is playing a bigger role, where they’re allocating capital more selectively.”

Sheng says: “We think that is a better environment for alpha. We think that active allocation as well as manager selection is where you can also get the boost in terms of returns over the next 10 to 15 years.”

How to Maximize Real Returns

To improve portfolio returns, Sheng thinks illiquidity premium, which can be drawn from alternative assets such as private equity, is one that is often under-utilized in portfolios to maximize risk-return among more sophisticated investors.

For investors without access to financial alternative investments, real assets investment is an option to differentiate portfolio returns and hedge the shock from inflation. Gold, other commodities and REITs can be considered.

She continues: “That's why we think some of that allocation into real assets or commodities can help with that hedge, especially when you look at the stock-bond correlation, probably in the last few years, already moving positive. Bonds will not give you that inflationary hedge, but commodities can.” In the study, gold, in U.S. dollar terms, is expected to generate a return of 4.1% each year for the next 10 years. U.S., Europe, and global REITs will give out an annualized return of around 8%.

Buy Low and Hold

Other than adding diversifiers and return enhancers to the portfolio, investors should manage overall valuations and turnover. Jason Kephart, director of multi-asset ratings at Morningstar, observes that lower valuations have typically led to better future returns.

“It’s a fool’s errand to try market-timing a core holding like the 60/40 portfolio (and most investments), but keeping valuations in mind can help set expectations and keep investors from hurting their results by buying and selling at the wrong times,” Kephart says.

While it is recommended to hold a balanced fund for six to 10 years, with past data supporting his research, Kephart finds investors can improve their odds of success with a 60/40 portfolio by holding it longer.

He explains: “Over one year, there’s about a one in five chance of losing money, but over 15 years the odds drop to less than 1%. There’s no guarantee that a 1% chance of loss won’t happen or won’t be painful, but it confirms Morningstar’s recommendation to hold the portfolio for longer periods.”

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DSZYYKGIYFHBRCV5ODLKEA4PWU.jpg)

.png)

.jpg)