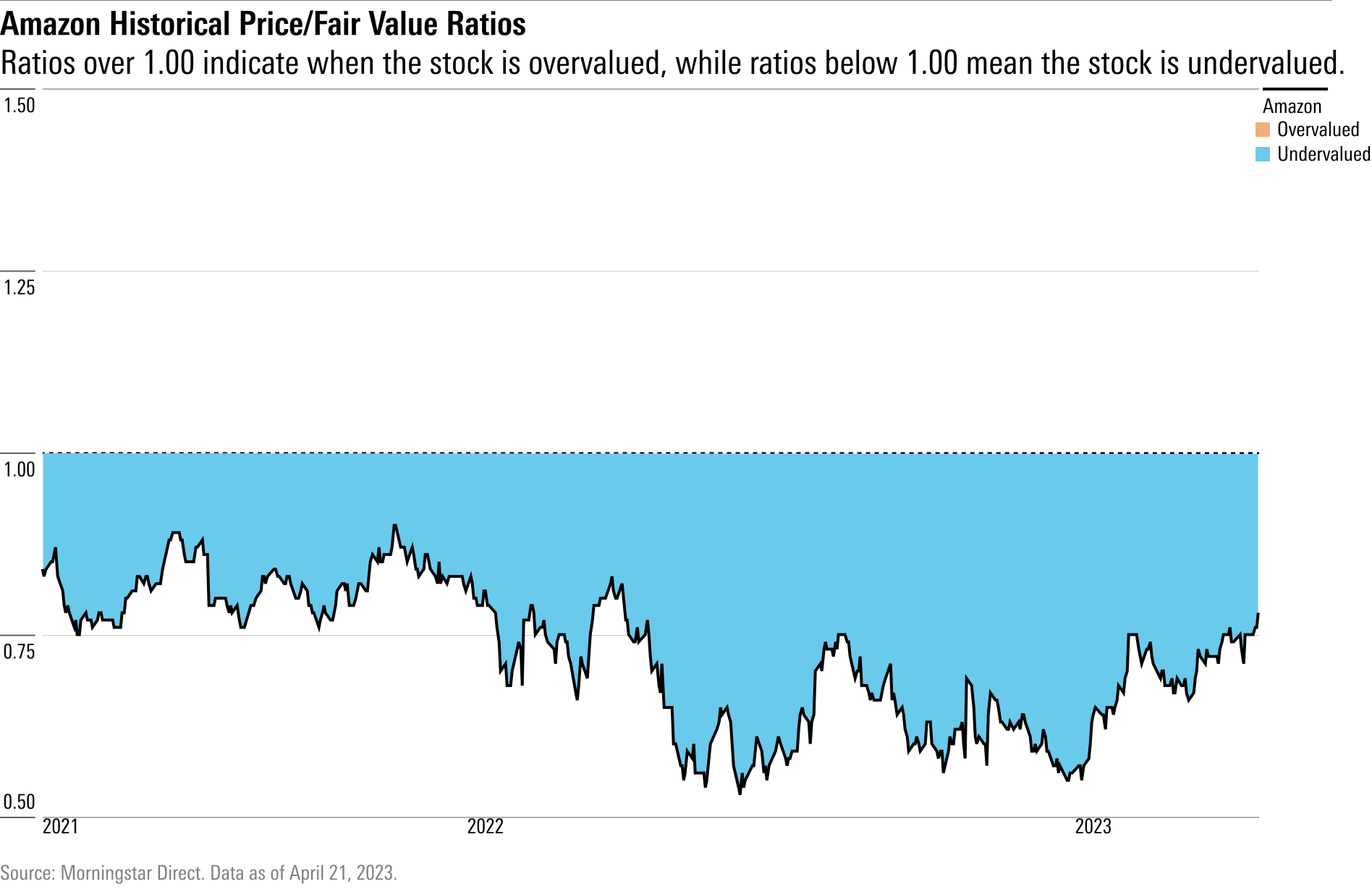

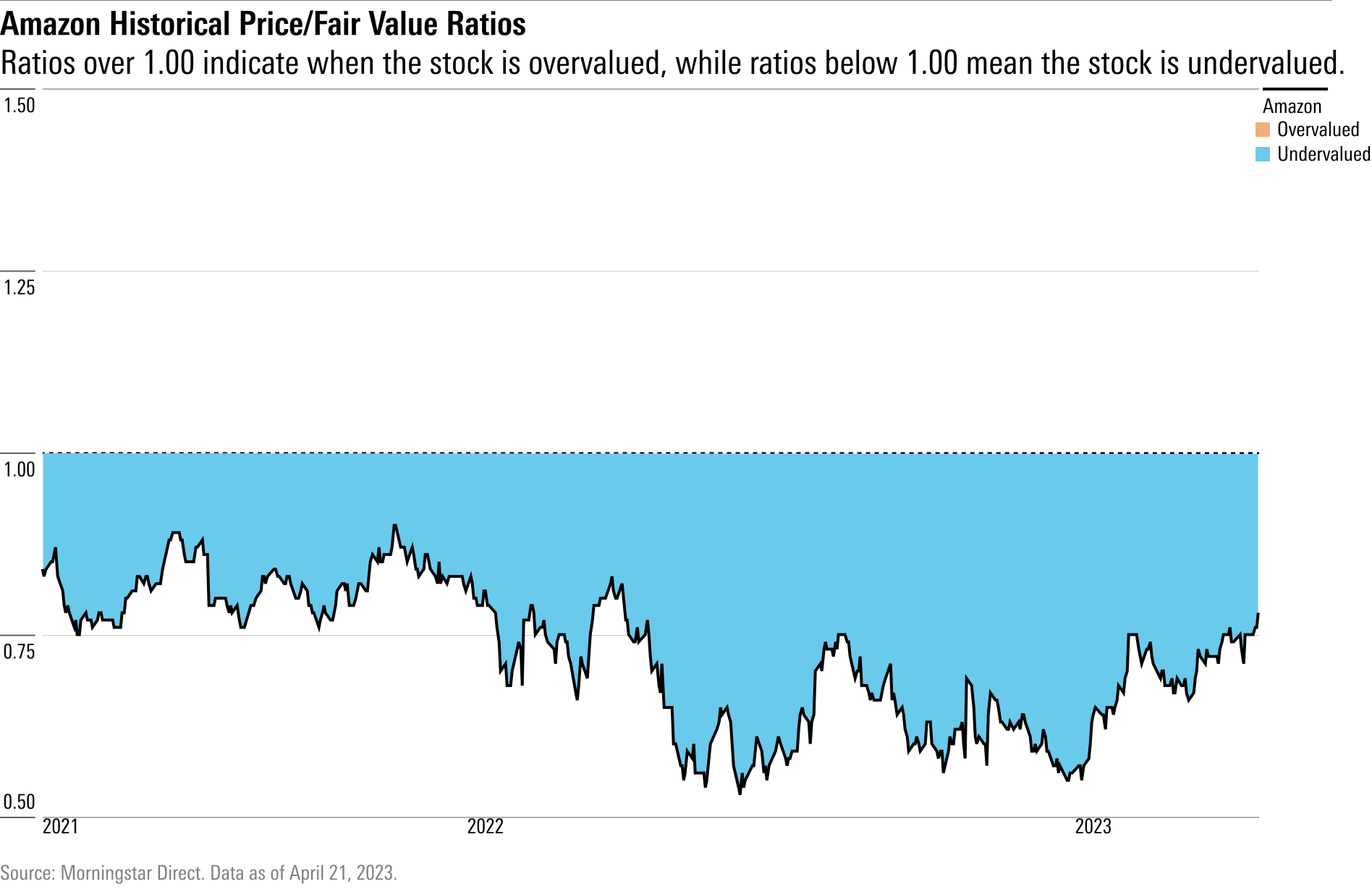

At a 4-star rating, we believe Amazon stock is undervalued when compared with our fair value estimate.

Our fair value estimate for Amazon is $137 per share, which implies a 2022 enterprise value/sales multiple of 3 times and a 1.7% free cash flow yield. We think multiples are a little less meaningful for Amazon given the ongoing heavy investment and rapid scaling that depresses financial performance. Over the long term, we expect e-commerce to continue to take share from brick-and-mortar retailers. We further expect Amazon to gain share online. We think Prime subscriptions and the accompanying benefits, combined with selection, price, and convenience continue to drive its retail story. We believe the critical growth drivers over the medium term will be Amazon Web Services and advertising. Since these segments earn materially higher margins than the rest of the business, we also expect them to drive margins higher over time.

What to Watch for in Amazon’s Quarterly Earnings

1) We want to know about AWS growth, and backlog if provided. This has been decelerating meaningfully for the past several quarters as customers are taking the time to make sure they are maximizing their contracts during macroeconomic uncertainty. AWS is one of two key growth drivers for the company. This is a near-term headwind and growth should reaccelerate, but it’s not clear that it will do so this quarter or next.

2) Advertising is the other key growth driver. Both AWS and advertising are high-margin businesses. The internet companies were all showing weakness last quarter. Amazon advertising definitely slowed but seems to be holding up better than, say, Meta Platforms META or Alphabet GOOGL. In late March Amazon did another round of layoffs—more salespeople, and some advertising folks as well—which suggests things have not improved since early February when it reported fourth quarter 2022 results.

3) E-commerce trends should be an obvious point. We’re expecting in-line or better results, while consensus seems to expect something slightly better still (but not far off). In other words, consumer demand is not deteriorating further.

4) We want to hear about margin impact going forward, from about 27,000 workers being let go over the last couple of quarters.

Economic Moat Rating

We assign a wide Morningstar Economic Moat Rating to Amazon based on network effects, cost advantages, intangible assets, and switching costs. Amazon has been disrupting the traditional retail industry for more than two decades while also emerging as the leading infrastructure-as-a-service provider via AWS. We believe Amazon’s retail business has a wide moat stemming from network effects associated with its marketplace, where more buyers and sellers continually attract more buyers and sellers; a cost advantage tied to purchasing power, logistics, vertical integration (proprietary brands, owned delivery, and so on), and a negative cash conversion cycle; and intangible assets associated with technology and branding. Low prices and unmatched selection have come to define the company in consumer’s minds, giving rise to intangible assets from branding and technology (search capabilities and recommendation engine). Prime memberships generate high cash flow that can be reinvested in further improving the user experience on the technology, content, and delivery fronts. Advertising is tangentially related to Amazon’s retail operations in that it takes place on Amazon’s own online properties. Advertising is growing rapidly and is likely the segment with the highest operating margins in Amazon’s portfolio. Amazon has amassed significant technology and process knowledge, which we believe is an intangible asset for the firm as a whole and also for AWS.

Risk and Uncertainty

We believe that the uncertainty for Amazon is high. Despite being an e-commerce leader, the company faces a variety of risks. Amazon must protect its leading online retailing position, which can be challenging as consumer preferences change—especially during pandemic recovery, as consumers may revert to prior behaviors—and traditional retailers bolster their online presence. Similarly, the company must also maintain an attractive value proposition for its third-party sellers. It must also continue to invest in new offerings. AWS, transportation, and physical stores (both Amazon-branded and Whole Foods) are three notable areas of investment. Continued international expansion will likely require similar investment and management attention, but it will also increase exposure to different regulatory environments. From an environmental, social, and governance perspective, data breaches and service outages are a concern for any type of cloud service provider.

AMZN Bulls Say

- Amazon is the clear leader in e-commerce and enjoys unrivaled scale to continue to invest in growth opportunities and drive the very best customer experience.

- High-margin advertising and AWS are growing faster than the corporate average, which should continue to boost profitability over the next several years.

- Amazon Prime memberships help attract and retain customers who spend more with Amazon; this reinforces a powerful network effect while bringing in recurring and high-margin revenue.

AMZN Bears Say

- Regulatory concerns are rising for large technology firms, including Amazon. Further, the firm may face increasing regulatory and compliance issues as it expands internationally.

- New investments, notably in fulfillment, delivery, and AWS, should damp free cash flow growth. Also, Amazon’s penetration into some countries might be harder than in the U.S. owing to inferior logistic networks.

- Amazon may not be as successful in penetrating new retail categories, such as luxury goods, due to consumer preferences and an improved e-commerce experience from larger retailers.

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LHClvsQ Tt tQvUL jOfTGOW YbBkcL OVud nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq ParDYIZ mbcQO fTEDhm tSllS srOx LrGDI IyHvPjC EW bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhNl VlZf Jy Yy DFrNn izGq uV nVrujl kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk

To view this article, become a Morningstar Member.

Register For Free

What Caused 2023's 'Everything' Rally?

What Caused 2023's 'Everything' Rally?

2023: The Best and Worst Stock Performers in Hong Kong

2023: The Best and Worst Stock Performers in Hong Kong

Upcoming changes to our membership offerings, tools, and features

Upcoming changes to our membership offerings, tools, and features

.png) 2025 Morningstar Fund Awards Winners

2025 Morningstar Fund Awards Winners

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

Markets Brief: If Tesla Stock is Falling, Why Is It Still Expensive?

Markets Brief: If Tesla Stock is Falling, Why Is It Still Expensive?

6 Undervalued US Stocks That Just Raised Dividends

6 Undervalued US Stocks That Just Raised Dividends